The African Development Bank Group’s Affirmative Finance Action for Women in Africa (AFAWA) program is lending its support to a new $50 million financing agreement to provide financial and business support to Nigeria’s women-led enterprises.

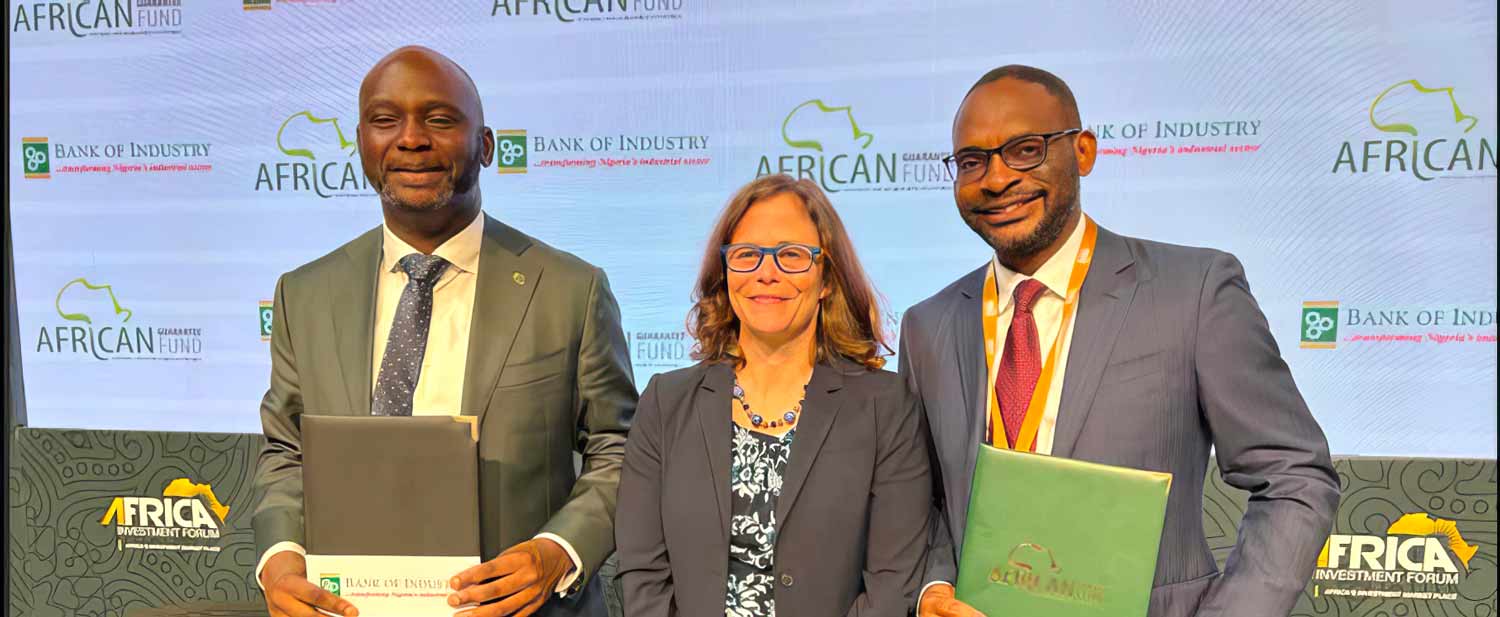

The African Guarantee Fund and Bank of Industry signed the $50 million loan portfolio guarantee framework at the Africa Investment Forum in Rabat on Thursday 5 December. The transaction will be phased out in three tranches over a ten-year period and will significantly scale up lending from Bank of Industry - Nigeria’s oldest and largest development financing institution - to small and medium enterprises in the country. The new deal will support women-led businesses via the AFAWA Guarantee for Growth program, which makes financing available for women entrepreneurs through de-risking and technical assistance measures. The African Guarantee Fund implements the AFAWA Guarantee for Growth program.

“This strategic partnership illustrates the commitment of the African Development Bank, especially the Affirmative Finance Action for Women in Africa initiative, to empower women entrepreneurs and foster economic growth in Nigeria,” Dr. Beth Dunford, African Development Bank’s Vice President for Agriculture, Human and Social Development, told signing ceremony attendees.

“This is not just a financial transaction aimed at supporting and catalysing the growth of small and medium enterprises in Nigeria - it is a beacon of hope and progress for African businesses, particularly for those led and owned by women,” she added.

The partnership includes a comprehensive risk sharing mechanism that focuses on supporting micro, small and medium enterprises, women-owned enterprises and “green businesses” that promote environmental sustainability and gender equity.

African Guarantee Fund Group Chief Executive Officer, Jules Ngankam said, “This transaction with the leading development finance institution in Nigeria is a great milestone that will significantly impact Nigeria’s economy by unlocking up to $100 million in financing for small and medium enterprises. African Guarantee Fund will also provide tailored guarantees and technical assistance towards the special small and medium enterprise products offered by Bank of Industry that target women, youth and green businesses.”

This agreement signifies the start of a long-term strategic relationship and blending AFAWA’s goal to reduce the financing gap Africa’s women entrepreneurs face compared to men, African Guarantee Fund's mission to unlock financing for small and medium enterprises, and Bank of Industry’s mandate to catalyse Nigeria's industrialization and economic transformation.

“Bank of Industry is excited to leverage the guarantee framework of the African Guarantee Fund in promoting sustainable growth, gender equity, innovation and advancing more credit to small and medium enterprises in Nigeria in line with [Nigeria] President Bola Tinubu’s government’s Renewed Hope agenda,” said Dr. Olasupo Olusi, Bank of Industry’s Managing Director and CEO.

Through the African Development Bank, AFAWA has approved more than $2.4 billion in lending for Africa’s women-led small and medium enterprises, as well as partnered with 185 financial institutions responsible for disbursing the funds across 44 African countries. The initiative has unlocked financing to more than 18,600 women-led small and medium enterprises. AFAWA is supported by the African Development Bank's partners and donors: the Women's Entrepreneurs Finance Initiative (We-Fi), G7 participating countries Canada, France, Germany and Italy as well as the Netherlands and Sweden.