Demand for more extensive rail infrastructure in Africa received a boost following the coming into force of the African Continental Free Trade Agreement in early 2021. The agreement aims to boost intra-regional trade and integration, two goals that rail corridors meet.

In March 2022, during virtual boardroom sessions organized by the Africa Investment Forum, (link is external) investors, deal brokers and government ministers came together looking to spur more railway deals. Deeper rail networks would boost Africa’s economic integration and the participants in these meetings, which work to bring transactions to financial closure, are well aware that the needed financing will come from the private sector and international financial institutions.

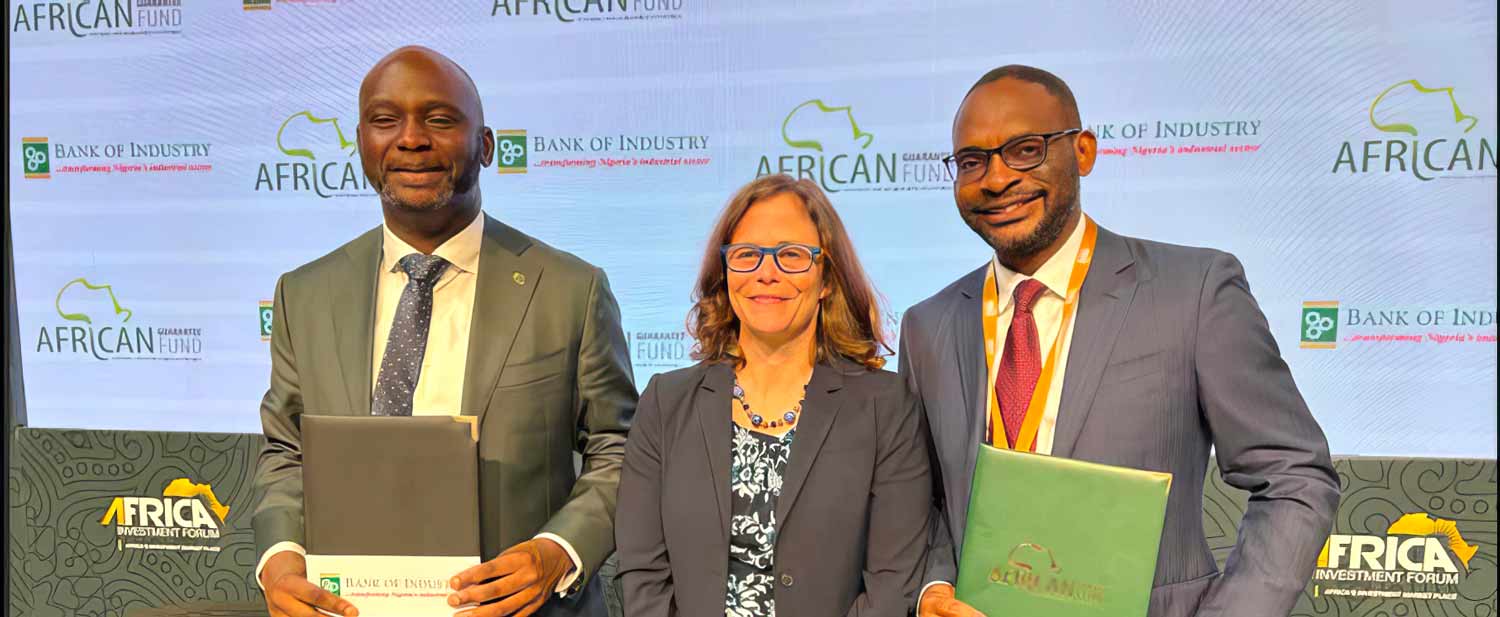

The Africa Investment Forum is Africa’s premier platform for advancing deals toward financial closure. Its Market Days event, held annually, includes boardroom sessions that showcase billions of dollars in agribusiness, transport and energy deals, among other critical sectors, to investors.

Market Days has played a role in brokering previous rail deals. At Market Days 2019, held in Johannesburg, Afreximbank and Thelo DB signed a Memorandum of Understanding to develop, finance and operate railway projects across Africa. Afreximbank is a founding partner of the Africa Investment Forum. Thelo DB is a partnership between Thelo Ventures of South Africa and Germany’s Deutsche Bahn Engineering & Consulting.

Afreximbank and Thelo were party to an August 2022 agreement with the Ghanaian government to upgrade the country’s Western Rail Line and increase its passenger and freight traffic. Under the deal, Afreximbank will secure financing for the development of a 300 km stretch of the line. Thelo will manage the rail infrastructure.

At Africa Investment Forum Market Days 2022, taking place in Abidjan, Côte d'Ivoire from November 2 to 4, railway infrastructure will again be an important sector. Also mobilizing resources for railway transport systems through public-private partnerships will be an important part of the discussions.

African Development Bank Vice President For Private Sector, Infrastructure And Industrialization Solomon Quaynor, captured some of the challenges of building out railway systems during a September 2022 conference held in Johannesburg. “We need to explore various financing models, and we need to think of this differently,” he said. “For example, we need to finance corridors and not just national railways networks. We need to think Public Private Partnerships to leverage limited public capital, but we have to be aware of the risks that private sector will not bear,” Quaynor added

Market Days 2022 will showcase several railway projects in search of financing. It is also expected to showcase opportunities for investment in other transport sectors include road corridors, as well as agribusiness, communications infrastructure, healthcare, and creative sectors including fashion and film.

The transactions will be sourced from the investment pipelines of the platform’s eight founding partners. They are the African Development Bank, Africa50; the Africa Finance Corporation; the African Export-Import Bank; the Development Bank of Southern Africa; the Trade and Development Bank; the European Investment Bank; and the Islamic Development Bank.

Since its inception in 2018, the Africa Investment Forum platform has mobilized investment interest in excess of $100 billion.